A Comprehensive financial plan includes an analysis of the risks to the plan that must be considered. Risk Management;

- Identifies the risks that could threaten your financial security,

- Quantifies the risks,

- Determines if there is some way to mitigate (Avoid and or Reduce) the risks through planning and then do you (Retain or Assume) the risks or,

- Transfer the remaining risks that you are unable or unwilling to assume yourself to an insurance company (SHARE).

When asked what is your most significant asset many Canadians would respond with their home, or their car, or maybe even their RRSP or other investments; would you agree? We believe your ability to earn an income and provide for your family is your most significant asset. A sudden loss of income due to an illness or injury, a death, or a job loss can be devastating to a family.

Risks to your financial security that need to be analyzed include;

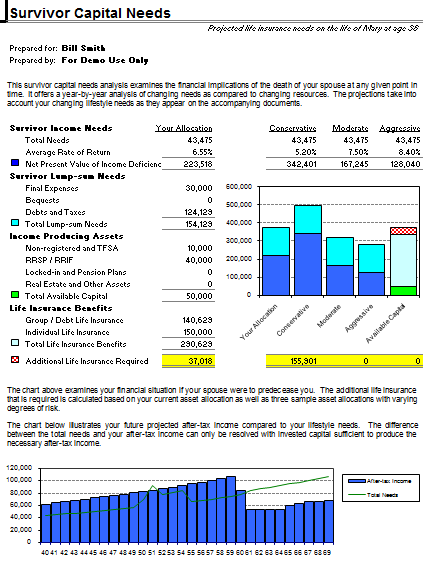

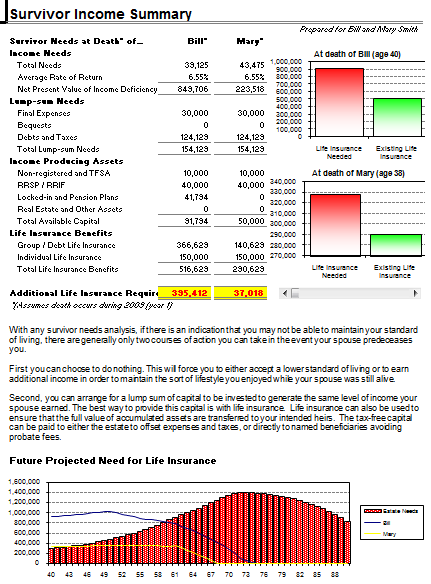

- Loss of income due to death

- Loss of income due to disability

- Loss of income and/or additional costs related to a Critical Illness

- Costs related to Long-term Care required due to health issues

- Unexpected large expenses

- Personal Liability

- Property loss

- Longevity; will you outlive your money

- Inflation; the erosion of your purchasing power

Insurance is simply a method of reducing risks to you and your family. We all have insurance on our homes and our cars, yet many people neglect to properly insure their ability to earn income and support their families.

There are many different types of insurance products that can be used to reduce the risk to your family from a sudden loss of income or an unexpected expense. The goal of an insurance plan is to provide the protection you need in the most cost efficient manner possible. Too much insurance or the wrong kind of insurance is just as ineffective as not enough insurance. We will provide you with the information you need to make decisions regarding your insurance needs that you are comfortable with.