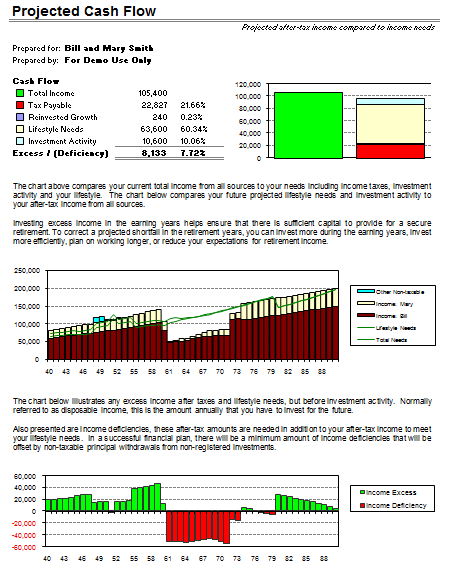

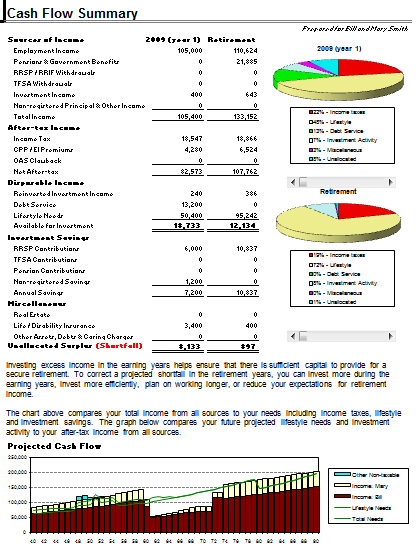

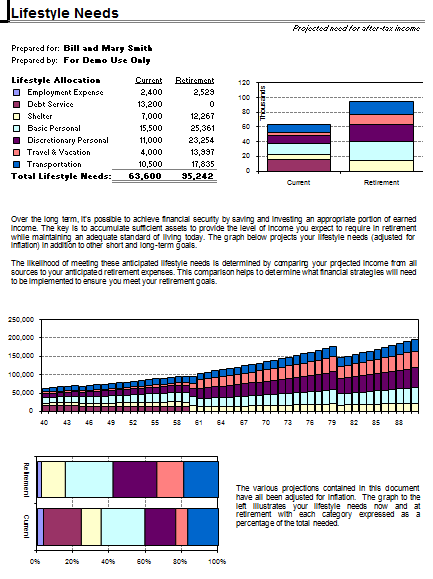

Do find that you have too much month at the end of your money? Or maybe even too much money at the end of the month? Having a clear idea of where your money goes each month and whether or not you have a surplus or deficit is a key part of a financial plan.

Cash Flow Management is the process of monitoring, analyzing, and adjusting your cash flows. The majority of families and individuals go through life one month at a time without a clear picture of where all their money is going and choose to simply save and/or invest what’s left over at the end of the month. The sad reality is that if there is anything left over at the end of the month, it usually isn’t enough to fund any sort of effective savings and investing plan. We will help shed light on where your money is going every month, we will help determine whether there is a surplus or deficit, and we will help build a plan to manage this surplus or deficit in the future.

Debt Management

Many Canadians have significant levels of debt; a mortgage, credit cards, lines of credit, student loans, or other forms of consumer debt. Understanding uses of debt and the difference between good debt, bad debt, and ok debt is crucial to securing your financial future.

We analyze your debt ratios and provide advice on how to maximize your credit rating, reduce interest expenses, and eliminate bad debt. Our Six Step Process to Debt Elimination has helped many families drastically reduce and even eliminate all bad debts.